One sign of having good financial health is the ability to save. The 50/20/30 rule for saving is a guideline developed by Elizabeth Warren, a U.S. senator and expert in bankruptcy law. She devised a method to manage income that ensures savings, explained in her book “All Your Worth: The Ultimate Lifetime Money Plan.”

The common approach to saving usually involves subtracting expenses from income and saving what’s left. The 50/20/30 rule takes a different perspective on calculating that amount.

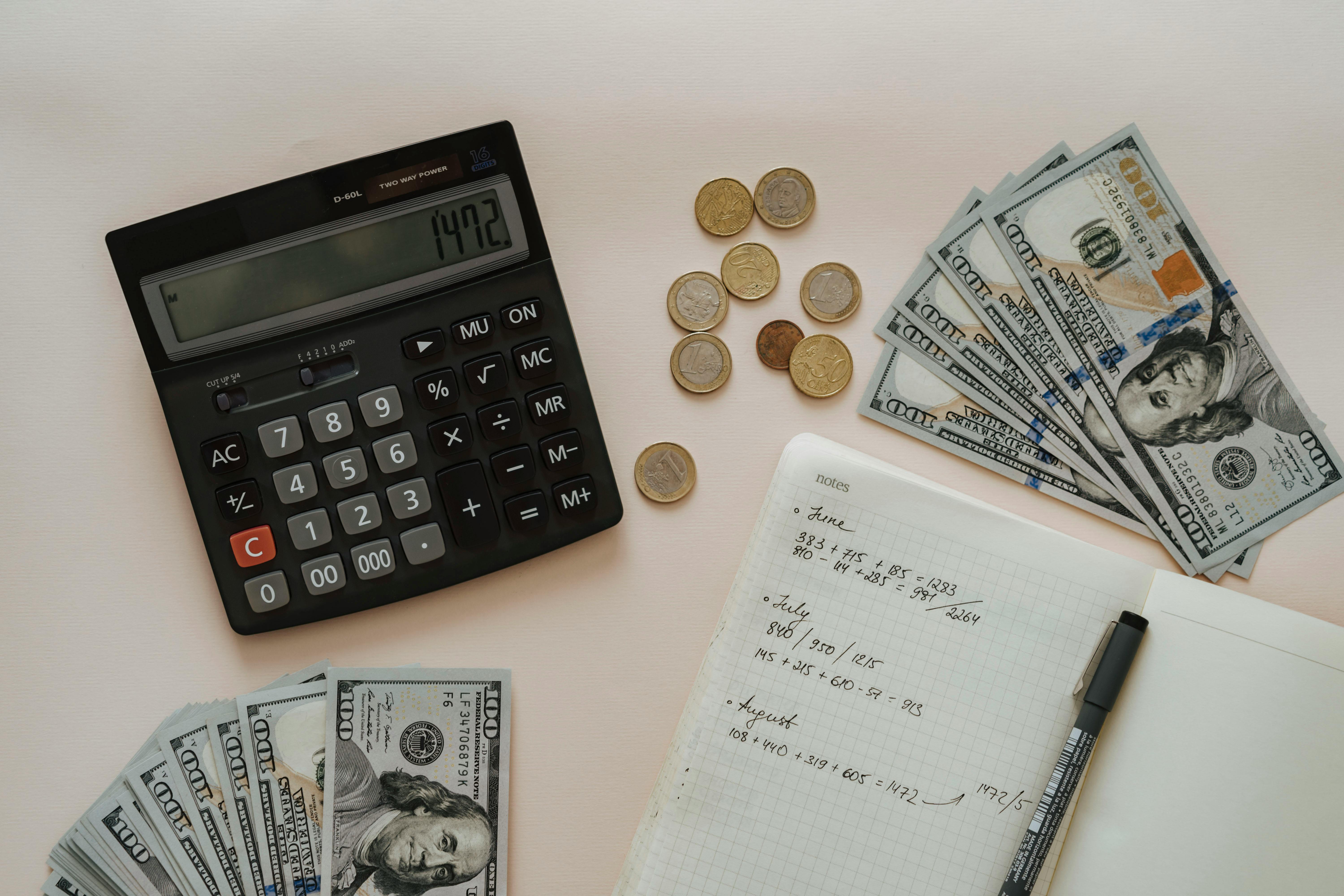

To apply this rule, you need to have a clear picture of your personal or household income and expenses. The best tool for this is a budget spreadsheet.

The 50/20/30 rule is based on your monthly net income, after taxes. The remaining amount is allocated as follows:

Essential needs may sometimes exceed 50%, so it’s important to clarify what counts here. Typical items include:

The 30% allocated for discretionary spending is often the hardest to manage. This includes activities that improve quality of life, such as dining out, gym memberships, movies, and travel. Planning is essential to keep these expenses within budget.

Saving 20% can be challenging. Some useful strategies include opening a separate account to deposit this money and setting it aside immediately when you receive your monthly salary or income. This helps you mentally adjust to the actual available funds for the month.

One limitation of this rule is that the 50% allocated to essentials is often insufficient for many people, especially given rising costs of food and transportation due to inflation.

It is also less practical for individuals with irregular or variable monthly income.

Other creative strategies can help gradually increase your savings:

Rounding method: Round up purchases and deposit the difference into a separate account. For example, if a loaf of bread costs €0.80 and you pay with €1, save the remaining €0.20.

You can also round to the nearest multiple of 5. For instance, if a purchase costs €3.18, round up to €5 and save the €1.82 difference.

For card payments, some banks offer digital tools—virtual piggy banks—to automate these small savings.

And you… have you decided which method you will use to boost your savings?